FAQs

The Redevelopment Plan only includes one redevelopment project.

Redevelopment project involves:

Repair, rehabilitation, or replacement of an existing structure located within a substandard and blighted area.

Redevelopment of a vacant lot located within a substandard and blighted area.

The redevelopment project must have been within the city limits for at least 60 years.

Vacant lot must have been platted for 60 years.

Assessed value when the redevelopment project is complete is estimated to be no more than:

$350,000 for a single-family residential structure

$1,500,000 for a multi-family residential structure or commercial structure

$10,000,000 for the revitalization of a structure included in the National Register of Historic Places

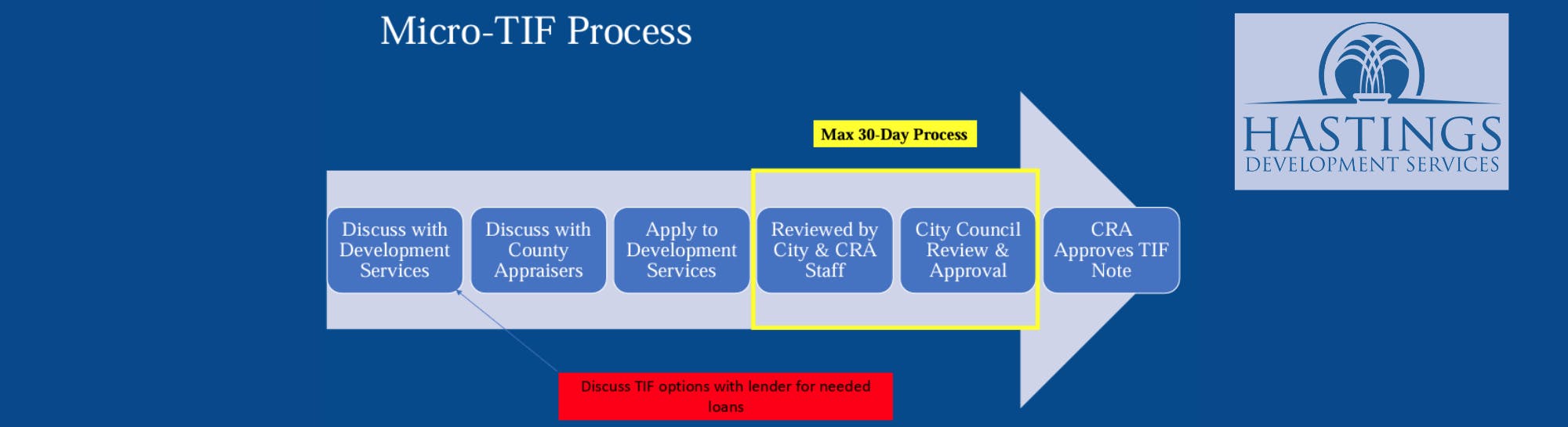

Applicant has a pre-application meeting with City to discuss the Micro-TIF process (Optional).

Meet with the County Assessor’s Office to discuss the redevelopment project to determine an estimate of the increase in property value and TIF eligibility.

Applicant submits Standard Form, Supplemental Form, & Owner Authorization Form by application deadline.

Standard Form requires an estimated increase in value from the County Assessor.

Owner Authorization Form is only needed if the Owner and Applicant are different.

The City Council approves or denies the redevelopment plan within 30 days of the application deadline.

Development Services notifies the applicant, CRA & County Assessor of the City Council decision.

CRA submits notice to divide taxes to the County Assessor.

Applicant notifies County Assessor of project completion. The project MUST be completed within two years of the redevelopment plan’s approval (step 4).

County Assessor submits Standard Certification Form to CRA.

CRA uses portion of taxes to pay indebtedness.

What is Micro-TIF?

Micro-TIF, or Expedited Review of Redevelopment Plans, allows smaller redevelopment projects on individual properties to use a simplified Tax Increment Financing process to help offset construction costs for a project. A qualifying redevelopment project can use the difference between the property taxes paid before the project and the property taxes anticipated to be owed as a result of the final redevelopment project and the new assessed value for the property for TIF-eligible expenses.

How is micro-TIF different from standard TIF?

The Micro-TIF program has a shorter time frame and has fewer approval procedures compared to the traditional TIF program.

What projects qualify for Micro-TIF?

What is the application process?